colorado estate tax requirements

The requirement to file also applies to any part-year resident who is either required to file a federal income tax return or. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

Inheriting A House In Colorado Things To Know Beforehand

The Division of Property Taxation coordinates and administers the implementation of property tax law throughout the state and operates under the leadership of the property tax administrator.

. A Colorado deed must have a top margin of at least 1 inch and left right and bottom margins of at least ½ inch. March 4 2016. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return.

For 2015 a filing is required for estates with. Education FSBO General. The amount that can escape federal estate taxation between generations otherwise known as the Generation-Skipping Transfer Tax Exemption GSTT is unified with the federal estate tax.

Real Wealth Network California S 1 Real Estate Club Creating Passive Income Real Estate Investing Estate. But generally for most couples having combined estate values under. Any retailer who does not maintain a physical location in Colorado is exempted from state sales tax licensing and collection requirements if the retail sales of tangible personal property.

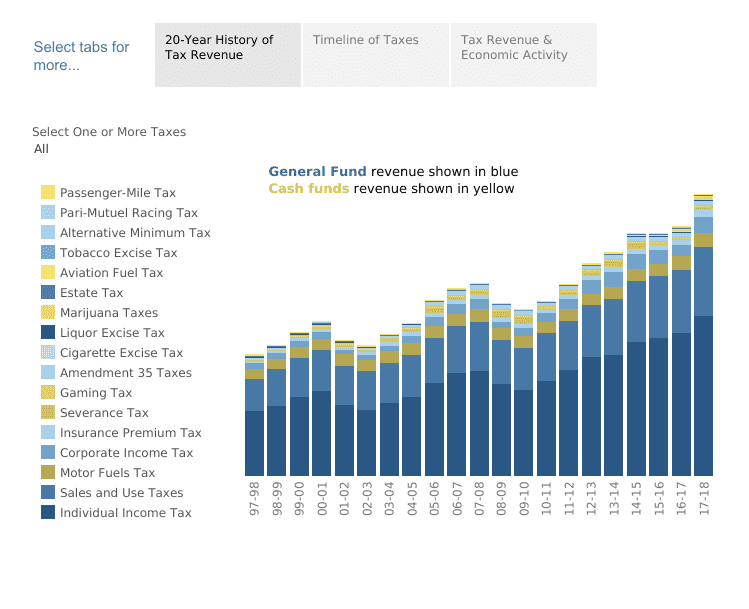

Colorado estate tax requirements Saturday March 19 2022 Edit. Every resident estate or trust and nonresident estate or trust with Colorado-source income must file a Colorado fiduciary income tax return if it is required to file a federal income tax return or if. For 2020 a filing is required for estates with.

Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return. Colorado Durable Power of Attorney Laws A. Colorado does not impose specific page-size requirements but.

Governor Polis signed HB22-1027 on January 31 2022 which extends the small business exception to destination sourcing requirements. The individual has incurred a Colorado tax liability for the tax year. However the federal government may tax your estate depending on the estates gross value.

They will average around half of 1 of assessed value. Every nonresident estate or trust with Colorado-source income must file a Colorado Fiduciary Income Tax Return if it is required to file a federal income tax return or if a resident estate or. For example if your spouses taxable income is 1 million you can avoid paying taxes on that amount.

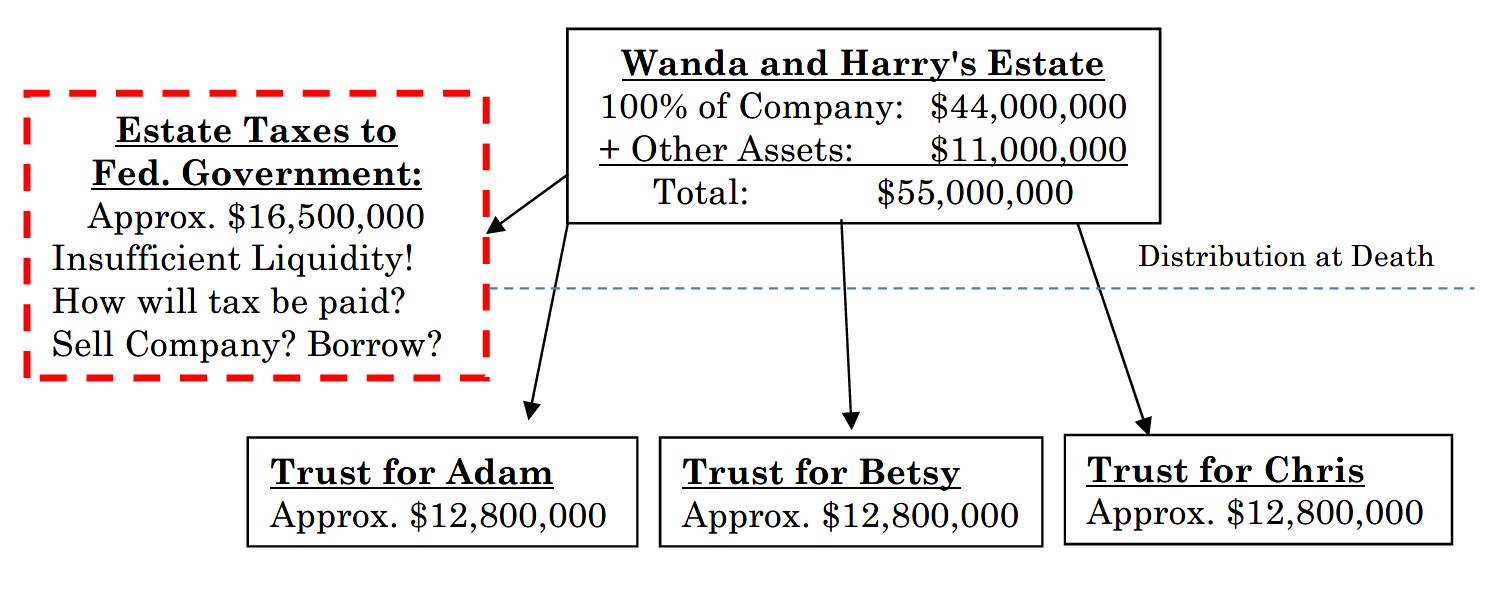

Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by. If youre subject to the estate tax youll need to know what your taxable. This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 million for couples An estate must have its own.

Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado. Estates can own property and receive income just like an individual or business. For information on how to.

Property taxes in Colorado are definitely on the low end. State wide sales tax in Colorado is limited to 29. If the estate or trust receives income a fiduciary income tax return must be filed.

This exception applies only to. Colorado wills laws set out requirements for the creation of a valid will including the age of the testator the number of witnesses and more.

Bill Would Give Homeowners Grants Tax Credit For Fire Mitigation 9news Com

Lesniak Urges Income Tax Hike Estate Tax Cut For Wealthy Nj Spotlight News

Part 2 Nobody Pays Estate Tax Anymore But Almost Everyone Has A Death Tax Problem

Lifetime Transfers Of Family Business Interests An Estate Tax Planning Opportunity In Uncertain Political Times Ward And Smith P A

Colorado Estate Tax The Ultimate Guide Step By Step

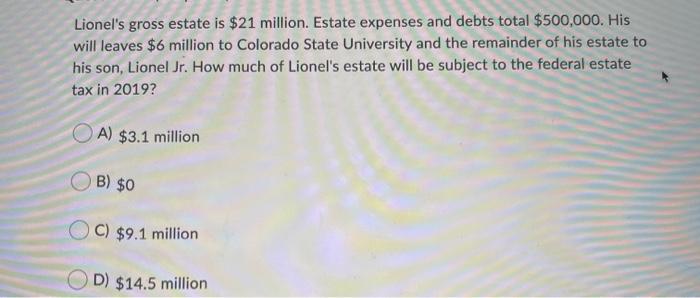

Solved Lionel S Gross Estate Is 21 Million Estate Expenses Chegg Com

Who Pays The Estate Tax Tax Policy Center

Do I Need To Worry About Estate Or Inheritance Taxes The Hughes Law Firm

Summit County Officials Explain Why Residents Are Seeing Higher Property Tax Bills This Year Summitdaily Com

How To Compute Your Estate Tax In The Philippines Kuripot Pinoy

Exploring The Estate Tax Part 1 Journal Of Accountancy

Free Colorado Last Will And Testament Template Pdf Word Eforms

Colorado Inheritance Laws What You Should Know Smartasset

Estates Trusts Department Of Revenue Taxation

Colorado Residents Must Respond To Major Estate Tax Proposal Boulder Estate Planning Legal Blog September 23 2021